Get the latest tech news

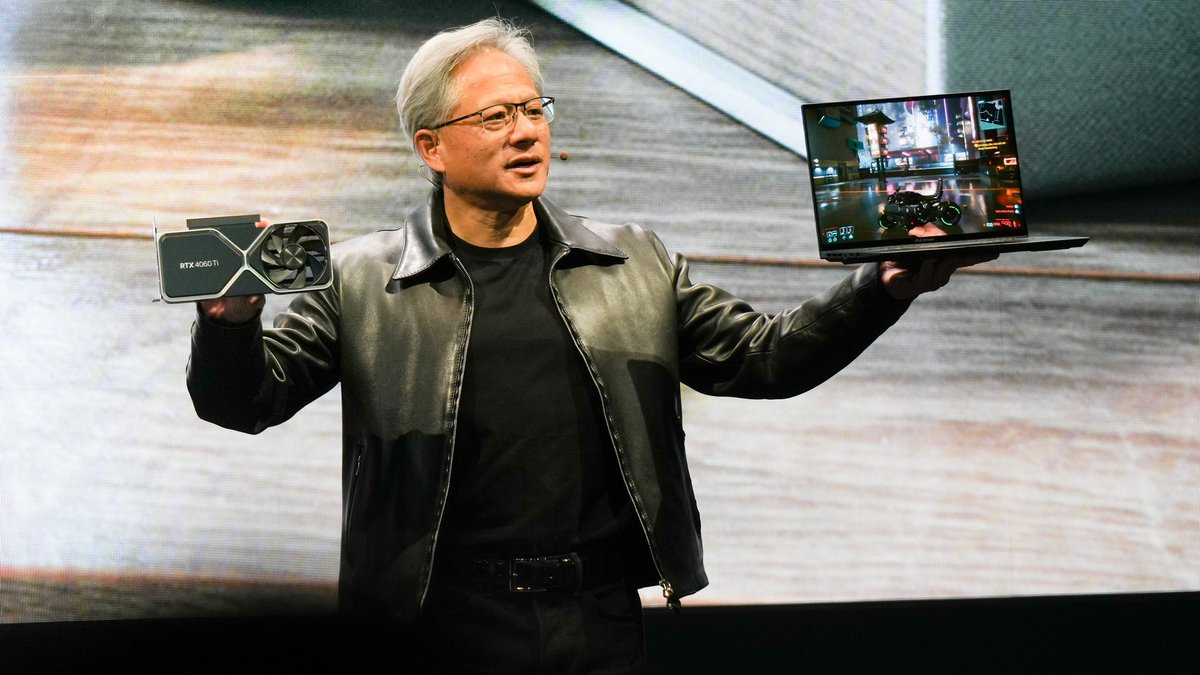

Here’s where Wall Street is looking in the search for the next Nvidia as AI hype spreads globally: ‘There’s a lot of low-hanging fruit to juice there.’

“In emerging markets, they are seeing AI as an under-appreciated driver going forward. There’s a lot of low-hanging fruit to juice there.”

At a time when the global euphoria about AI has propelled a three-fold surge in Nvidia Corp. and a 50% jump in a key US index for semiconductor manufacturers in less than a year, investors are pointing toward emerging markets for better value and a bigger pool of options. AI stocks are already leading a $1.9 trillion rebound in emerging markets this year, with Taiwanese and South Korean chip companies such as Taiwan Semiconductor Manufacturing Co. and SK Hynix Inc. accounting for 90% of the gains, according to data compiled by Bloomberg. For EM-focused exchange-traded funds, more than half of all inflows this year have gone into the iShares MSCI EM ex-China ETF, whose top 10 holdings include companies that are investing in AI, according to data compiled by Bloomberg.

Or read this on r/technology