Get the latest tech news

Late-stage VCs may be preventing their startups from going public in 2024

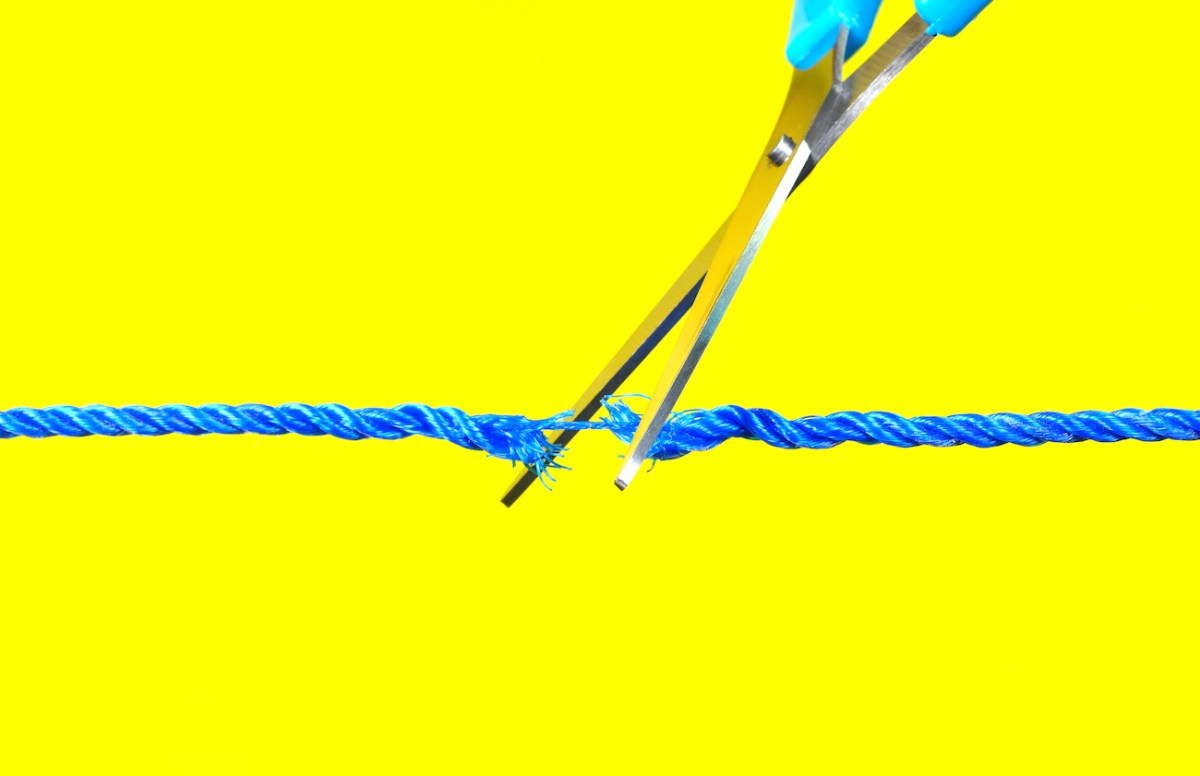

While some startups might be alright with an IPO at a lower valuation than their last round, their VCs might not allow it.

A lot of standard VC deal terms give investors the ability to block an IPO or acquisition if they didn’t think the timing or price was right, Eric Weiner, a partner at Lowenstein Sandler, told TechCrunch. Ryan Hinkle, a managing director at Insight Partners, said that before a company can go public, its investors with preferred shares — especially those that set the terms in the most recently raised round — have to want an IPO. “While I would have guessed a year ago that we would be closer to normal than now, SVB threw a big wrench in the world, the increased tensions in the Middle East, these moments of uncertainty introduces fear, doubt and risk,” Hinkle said.

Or read this on TechCrunch