Get the latest tech news

Some shareholders of a16z-backed Divvy Homes may not see a dime from $1B sale

Exclusive: Shareholders of a16z-backed Divvy Homes may not see a dime from $1B sale

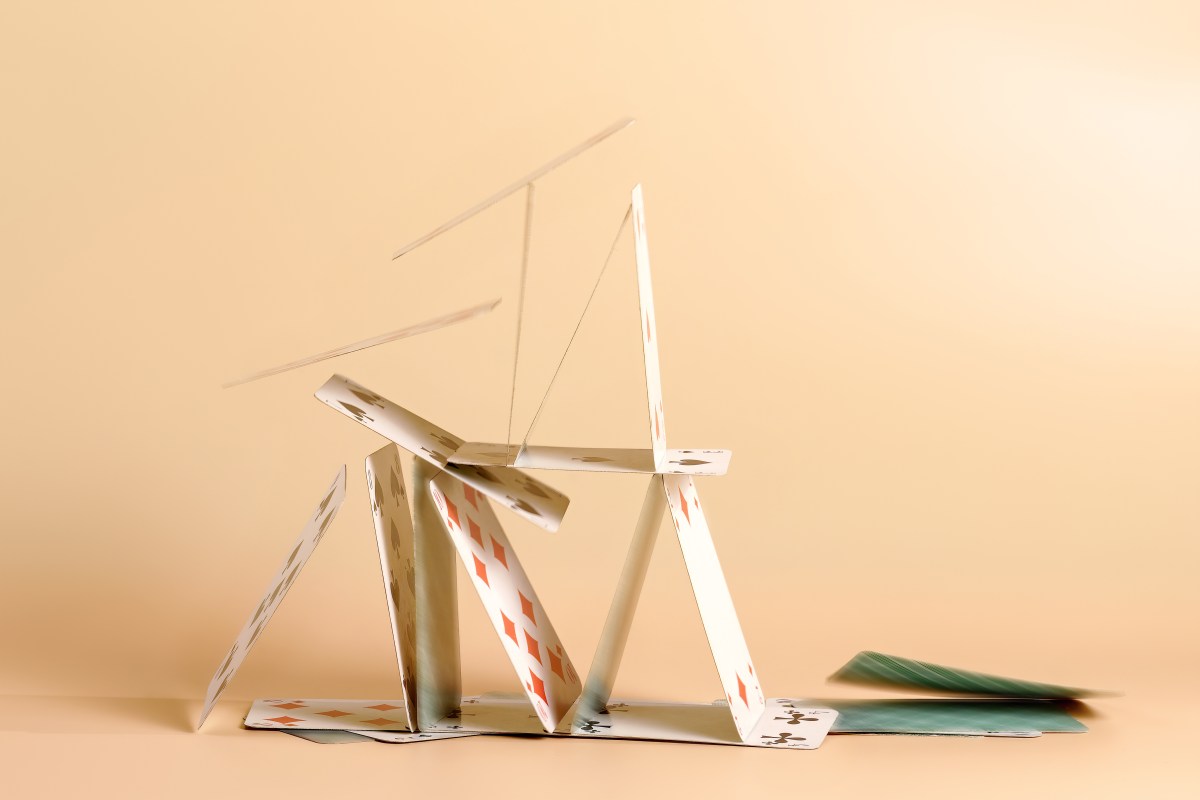

The terms — and Divvy’s journey from buzzy startup to acquisition target — reflects the rollercoaster ride the proptech industry has endured over the past decade. The San Francisco-based startup, founded in 2016, had raised more than $700 million in debt and equity from well-known investors such as Tiger Global Management, GGV Capital, and Andreessen Horowitz (a16z), among others. And while the Brookfield Properties purchase of Divvy for $1 billion was at half of its peak valuation, the acquisition could still be considered a win in an industry that has had a string of shutdowns and bankruptcies.

Or read this on TechCrunch