Get the latest tech news

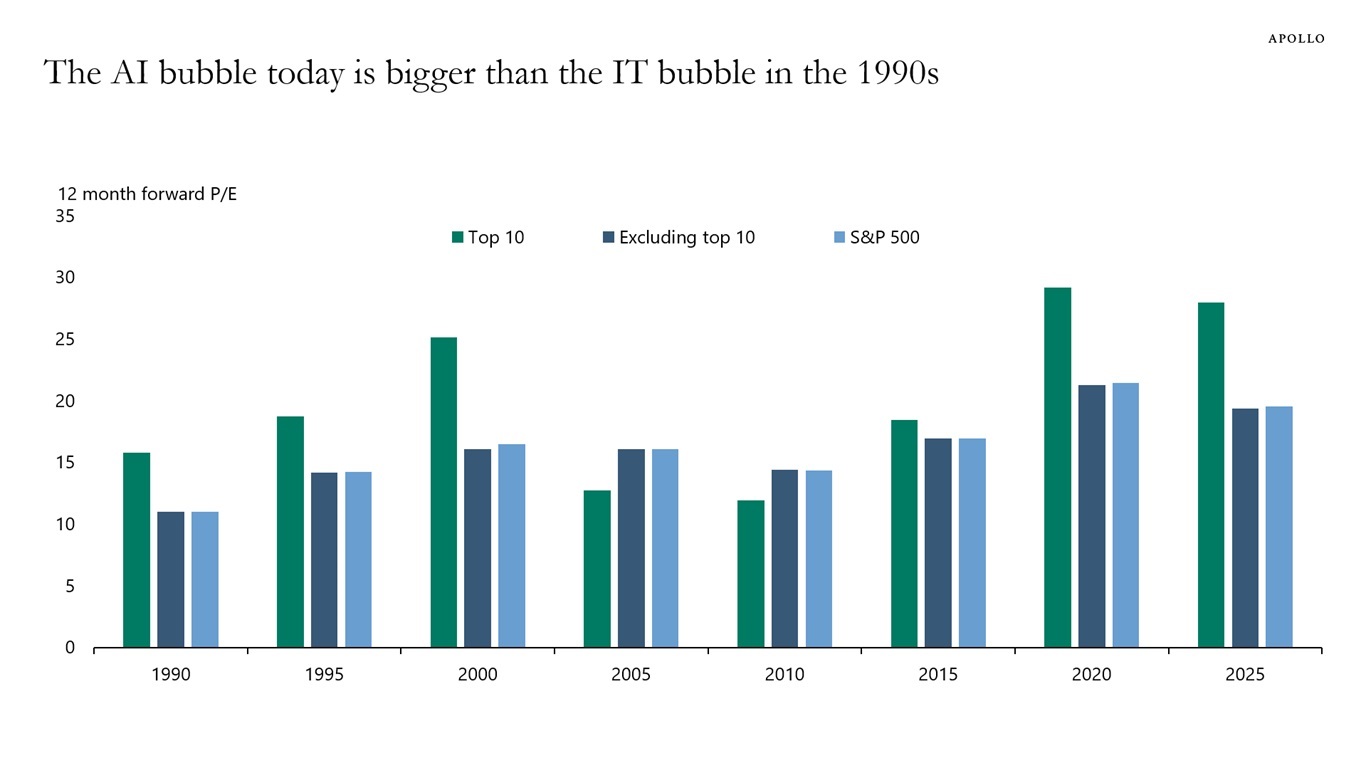

Wall Street's AI Bubble Is Worse Than the 1999 Dot-com Bubble, Warns a Top Economist

A chief economist at investment giant Apollo says the top ten AI stocks are more detached from reality than the tech titans of the 1990s were. His chart is a stark warning that history is about to repeat itself.

This means investors are betting so aggressively on AI giants like Nvidia, Microsoft, Apple, and Google that their stock prices have become detached from their actual earnings, even more so than tech darlings like Cisco and AOL were in the nineties. The top 10 companies driving this frenzy, which hold the most significant market value on Wall Street, include tech titans like Nvidia, Microsoft, Apple, Alphabet (Google), Amazon, and Meta. Wall Street is pricing in a perfect AI future without acknowledging the enormous risks: regulatory crackdowns, staggering compute costs, model hallucinations, or simply a slower than expected adoption rate.

Or read this on r/technology